Economics of Consumer Protection: Contributions and Challenges in Estimating Consumer Injury and Evaluating Consumer Protection Policy

The author examines the role of economics in consumer protection, drawing from her experience at the U. S. Federal Trade Commission (FTC), which has a dual mandate to promote competition and protect consumers. She compares the long established use of economics in competition law enforcement and policy to the relatively new application of economic analysis to consumer protection policy and law enforcement. She highlights contributions of economists to the development of consumer protection policy at the FTC and describes key questions involved in the economics of consumer protection policy. The focus of this article is on the definition and estimation of consumer injury from deceptive or unfair practices, including approaches to estimate consumer injury from lapses in data security and privacy policies and procedures. The paper brings together different strains of relevant economic literature, leading to a clearer exposition of alternative approaches to estimating consumer injury from an economic perspective. She also addresses, briefly, the debate over the role of behavioral economics in consumer policy, concluding that the appropriate tools for policymakers will vary depending upon their policy goals; policies appropriate to meet the goal of changing consumer choices in a particular direction may differ from policies suitable to meet the goal of improving the consumer information environment.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Subscribe and save

Springer+ Basic

€32.70 /Month

- Get 10 units per month

- Download Article/Chapter or eBook

- 1 Unit = 1 Article or 1 Chapter

- Cancel anytime

Buy Now

Price includes VAT (France)

Instant access to the full article PDF.

Rent this article via DeepDyve

Similar content being viewed by others

When Lying Does Not Pay: How Experts Detect Insurance Fraud

Article 12 April 2016

Further Challenges for Australian Consumer Law

Chapter © 2017

Information Obligations and Disinformation of Consumers: Finnish Law Report

Chapter © 2019

Explore related subjects

- Artificial Intelligence

- Medical Ethics

Notes

Strategic plans and annual reports provide an overview of of an agency's goals and results. In addition, the joint conference between the FTC and the Journal of Ecnomic Inquiry provides insight into the role of economics on consumer protection policy.

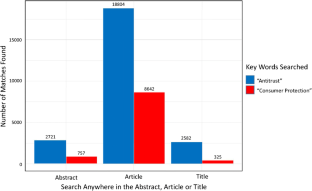

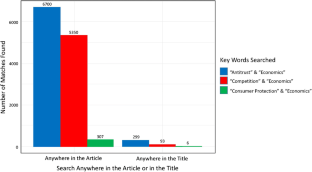

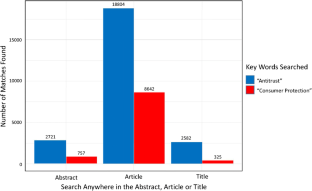

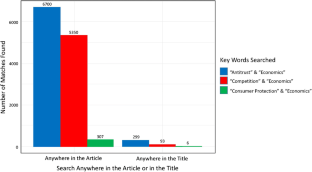

Econlit Database, Economics Research Database, EBSCO, https://www.ebsco.com (searched on April 24, 2018).

Google Scholar, https://scholar.google.com (searched on April 24, 2018). “Search in the abstract” option is not available on Google Scholar.

Although Beales et al. (1981) note that consumer injury is an important determinant of the costs and benefits of government intervention, the term “consumer injury” appears only once in this seminal article.

To the extent that the concept of “consumer injury” from deception appears in the economics literature, thus far, the focus is generally on static models. Even more work needs to be done to consider the dynamic effects.

Despite the benefits of controlled copy-testing to ensure that alleged misleading claims really are really misleading to the relevant audience, as a practical matter, rigorous consumer research is costly, and the cost of such testing may not outweigh the benefits (Owen and Plyler 1991; Pappalardo 1997a, b).

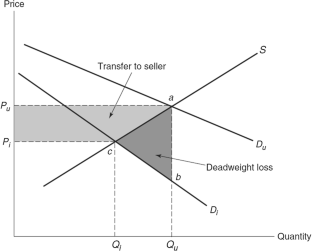

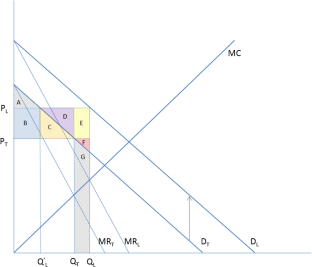

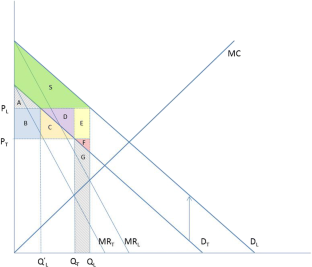

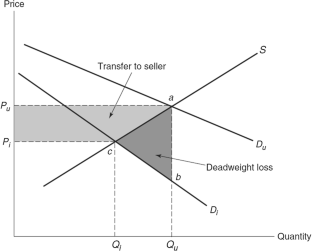

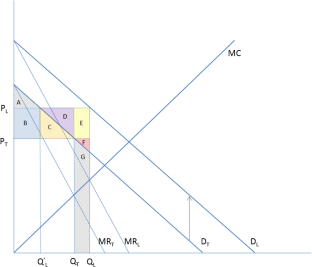

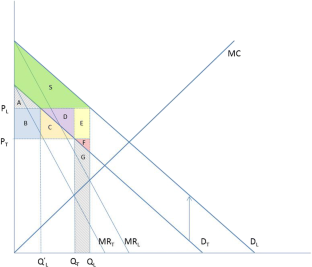

Similar diagrams and analyses appear in the industrial organization textbook by Carlton and Perloff (1994) and a paper by Bagwell (2005) later incorporated into the Handbook of Industrial Organization (2007). Both papers cite back to the work by Dixit and Norman (1978).

Notably, Schmeiser is a former staff economist in the Bureau’s Division of Consumer Protection.

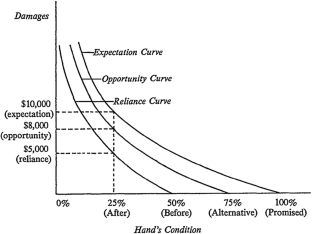

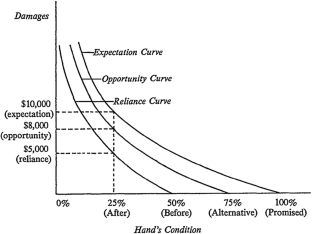

Cooter and Eisenberg (1985) cite the case at p. 1436 as 84 N.H. 114, 146 A. 641 (1929).

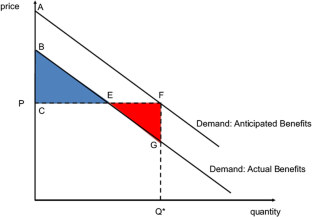

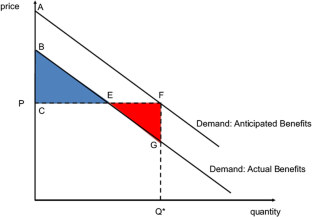

This representation of expectations damages appears to be consistent with the description of expectations damages in a working paper by McFadden and Train, (2019, p. 14). McFadden and Train extend Train (2015) to include consideration of a price increase that can arise when firms over-sell product attributes. McFadden and Train develop a new welfare measure, the Market Compensating Equivalent, and present it as an “. . . updated, practical version” of Marshallian Total Surplus (p. 4) and provide estimating equations for various damages concepts. They also describe welfare calculus in a product market using a graph similar to the ones presented earlier.

References

- Abernathy, A. M., & Franke, G. R. (1998). FTC regulatory activity and the information content of advertising. Journal of Public Policy & Marketing, 17, 239–256. ArticleGoogle Scholar

- Acquisti, A., Taylor, C., & Wagman, L. (2016). The economics of privacy. Journal of Economic Literature, 54, 442–492. ArticleGoogle Scholar

- Allcott, H. (2013). The welfare effects of misperceived product costs: Data and calibrations from the automobile market. American Economic Journal: Economic Policy, 5(3), 30–66. Google Scholar

- Allcott, H., & Taubinsky, D. (2015). Evaluating behaviorally motivated policy: Experimental evidence from the lightbulb market. The American Economic Review, 105, 2501–2538. ArticleGoogle Scholar

- Allen, M. A., Hall, R. E., & Lazear, V. A. (2011). Reference guide on estimation of economic damages. In National Research Council, Reference Manual on Scientific Evidence (3rd ed., pp. 425–502). National Academies Press.

- Anderson, K. (2004). Consumer fraud in the United States: An FTC survey. Federal Trade Commission.

- Anderson, K. (2007). Consumer fraud in the United States: The second Federal Trade Commission survey. Report. Federal Trade Commission.

- Anderson, K. (2013). Consumer fraud in the United States, 2011: The third FTC survey. Federal Trade Commission.

- Anderson, K. B. (2016). Mass-market consumer fraud: Who is most susceptible to becoming a victim? (Federal Trade Commission Working Paper No. 332). Federal Trade Commission.

- Arad, A., & Rubinstein, A. (2017). Multi-dimensional reasoning in games: Framework, equilibrium, and applications. (Tel Aviv University Working Paper).

- Armstrong, M. & Porter, M. (Eds.), (2007). Handbook of Industrial Organization (Vol. 3). Elsevier.

- Bagwell, K. (2005). The economic analysis of advertising. (Department of Economics Discussion Paper Series, Columbia University Discussion Paper No. 0506-01). https://doi.org/10.7916/D8QZ2P6X.

- Bagwell, K. (2007). The economic analysis of advertising. In M. Armstrong & R. Porter (Ed.), Handbook of Industrial Organization (Vol. 3, pp. 1701–1844). Elsevier.

- Baye, M. R., & Wright, J. D. (2018). How to economize consumer protection (March 9, 2018, Antitrust Source, February 2018, Kelley School of Business Research Paper No. 18-20, George Mason Law & Economics Research Paper No. 18-11. https://ssrn.com/abstract=3137122 (accessed 23 Dec 2021).

- Beales, H., Craswell, R., & Salop, S. C. (1981). The efficient regulation of consumer information. Journal of Law & Economics, 24, 491–539. ArticleGoogle Scholar

- Becker, G. S. (1968). Crime and punishment: An economic approach. Journal of Political Economy, 76, 169–217. ArticleGoogle Scholar

- Ben-Shahar, O. (2018). Data pollution. (University of Chicago Law School Working Paper No. 679).

- Beshears, J., Choi, J. J., Laibson, D., & Madrian, B. C. (2018). Behavioral household finance. (National Bureau of Economic Research Working Paper No. 24854).

- Boardman, A. E., Greenberg, D. H., Vining, A. R., & Weimer, D. L. (1996). Cost benefit analysis: Concepts and practice. Prentice Hall, Inc..

- Boardman, A. E., Greenberg, D. H., Vining, A. R., & Weimer, D. L. (2018). Cost benefit analysis: Concepts and practice (5th ed.). Cambridge University Press.

- Bond, R. S., Kwoka Jr., J. E., Phelan, J. J., & Whitten, I. T. (1980). Staff report on effects of restrictions on advertising and commercial practice in the professions: The case of optometry. Report. Federal Trade Commission.

- Butler, S., & Garrett, G. (2015). The value of personal information to consumers of online services: Evidence from a discrete choice experiment. (University of California Santa Barbara, CA: NERA, Inc. Working Paper).

- Calfee, J. E., & Pappalardo, J. K. (1989). How should health claims for foods be regulated? An economic perspective. Federal Trade Commission.

- Calfee, J. E., & Pappalardo, J. K. (1991). Public policy issues in health claims for foods. Journal of Public Policy & Marketing, 10, 33–53. ArticleGoogle Scholar

- Caplin, A., & Dean, M. (2015). Revealed preference, rational inattention, and costly information acquisition. American Economic Review, 105, 2183–2203. ArticleGoogle Scholar

- Carlson, J., Jin, Z. G., Jones, M., O’Connor, J., & Wilson, N. (2017). Economics at the FTC: Deceptive claims, market definition, and patent assertation entities. Review of Industrial Organization, 51, 487–513. ArticleGoogle Scholar

- Carlton, D. W., & Perloff, J. M. (1994). Industrial organization (2nd ed.). Harper Collins.

- Carpio, C. E., & Isengildina-Massa, O. (2016). Does government-sponsored advertising increase social welfare? A theoretical and empirical investigation. Applied Economic Perspectives and Policy, 38, 239–259. ArticleGoogle Scholar

- CFPB. (2013). Consumer financial protection bureau, 12 CFR Parts 1024 and 1026 [Docket No. CFPB-2012-0028] RIN 3170-AA19 Integrated Mortgage Disclosures under the Real Estate Settlement Procedures Act (Regulation X) and the Truth In Lending Act (Regulation Z). Federal Register, 77, 51116–51457. Consumer Financial Protection Bureau.

- CFPB. (2018). Mortgage shopping study overview and methodology: Know before you owe: Mortgage shopping study – brief #1. Consumer Financial Protection Bureau.

- Cohen, P., Hahn, R., Hall, J., Levitt, S., & Metcalfe, R. (2016). Using big data to estimate consumer surplus: The case of Uber. (National Bureau of Economics Research Working paper No. 22627).

- Cooter, R., & Eisenberg, M. A. (1985). Damages for breach of contract. California Law Review, 73, 1432–1481. ArticleGoogle Scholar

- Corts, K. S. (2014). Finite optimal penalties for false advertising. Journal of Industrial Economics, 62, 661–681. ArticleGoogle Scholar

- Craswell, R. (1991). Regulating deceptive advertising: The role of cost-benefit analysis. Southern California Law Review, 64, 549–604. Google Scholar

- Craswell, R. (1997). Compared to what? The use of control ads in deceptive advertising litigation. Antitrust Law Journal, 65, 757–792. Google Scholar

- Darby, M. R., & Karni, E. (1973). Free competition and the optimal amount of fraud. The Journal of Law and Economics, 16, 67–88. ArticleGoogle Scholar

- Deaton, A., & Muellbauer, J. (1980). Economics and consumer behaviour. Cambridge University Press.

- Decker, C. (2017). Concepts of the consumer in competition, regulatory, and consumer protection policies. Journal of Competition Law & Economics, 13, 151–184. ArticleGoogle Scholar

- Dixit, A., & Norman, V. (1978). Advertising and welfare. The Bell Journal of Economics, 9, 1–17. ArticleGoogle Scholar

- Dixit, A., & Norman, V. D. (1979). Advertising and welfare: Reply. The Bell Journal of Economics, 10, 728–729. ArticleGoogle Scholar

- Dixit, A., & Norman, V. (1980). Advertising and welfare: Another reply. The Bell Journal of Economics, 11, 753–754. ArticleGoogle Scholar

- Fisher, F. M., & McGowan, J. J. (1979). Advertising and welfare: Comment. The Bell Journal of Economics, 10, 726–727. ArticleGoogle Scholar

- FTC. (2012). Report to Congress under section 319 of the Fair and Accurate Credit Transactions Act of 2003. Federal Trade Commission.

- FTC. (2015). Report to Congress under section 319 of the Fair and Accurate Credit Transactions Act of 2003. Federal Trade Commission.

- Friedman, D. D. (2000). Law’s order: What economics has to do with law and why it matters. Princeton University Press.

- FTC. (1979). Consumer information remedies: Policy session. Federal Trade Commission.

- FTC. (1980). FTC policy statement on unfairness (Appended to International Harvester Co., 104 F.T.C. 949, 1070 (1984). See 15 U.S.C. § 45(n)). Federal Trade Commission.

- FTC. (1983). FTC policy statement on deception. (appended to Cliffdale Associates, Inc., 103 F.T.C. 110, 174 (1984)). Federal Trade Commission.

- FTC. (1986). 1986 Annual Report. Federal Trade Commission. U.S. Government Printing Office.

- FTC. (2015). Report to Congress under Section 319 of the Fair and Accurate Credit Transactions Act of 2003. Federal Trade Commission.

- FTC. (2018a). Fiscal year 2017 performance report and annual performance plan for fiscal years 2018 and 2019. Federal Trade Commission.

- FTC. (2018b). Fiscal year 2019 congressional budget justification. Federal Trade Commission.

- FTC. (2018c). Strategic plan for fiscal years 2018–2022. Federal Trade Commission.

- FTC. (2018d). FTC consumer protection economics symposium in conjunction with Economic Inquiry. See opening panel discussion, retrieved at https://www.ftc.gov/news-events/events-calendar/consumer-protection-economics-symposium. (accessed 23 December 2021).

- FTC, & DOJ. (2010). Horizontal merger guidelines. Federal Trade Commission and Department of Justice.

- Hanner, D., Jin, G. Z., Luppino, M., & Rosenbaum, T. (2016). Economics at the FTC: Horizontal mergers and data security. Review of Industrial Organization, 49, 613–631. ArticleGoogle Scholar

- Hunter, J., Ioannidis, C., Iossa, E., & Skerratt, L. (2001). Measuring consumer detriment under conditions of imperfect information. Office of Fair Trading.

- Ippolitio, P. M., & Mathios, A. D. (1996). Information and advertising policy: A study of fat and cholesterol consumption in the United States, 1977-1990. Federal Trade Commission.

- Ippolitio, P. M., & Pappalardo, J. K. (2002). Advertising nutrition & health, evidence from food advertising 1977-1997. Federal Trade Commission.

- Ippolito, P. M. (1984). Consumer protection economics: A selective survey. From the proceedings of the Federal Trade Commission, Bureau of Economics’ consumer protection conference: Empirical approaches to consumer protection economics. Federal Trade Commission.

- Ippolito, P. M., & Mathios, A. D. (1998). Health claims in advertising and labeling: A study of the cereal market. Federal Trade Commission.

- Jin, G. Z., & Stivers, A. (2017). Protecting consumers in privacy and data security: A perspective of information economics. (May 22, 2017). Retrieved from SSRN: https://ssrn.com/abstract=3006172 or https://doi.org/10.2139/ssrn.3006172 (accessed 23 December 2021).

- Johnson, J. P., & Myatt, D. P. (2006). On the simple economics of advertising, marketing, and product design. American Economic Review, 96, 756–784. ArticleGoogle Scholar

- Kwoka Jr., J. E. (2005). The Federal Trade Commission and the professions: A quarter century of accomplishments and some new challenges. Antitrust Law Journal, 72, 997–1012. Google Scholar

- Lacko, J. M. (1986). Product quality and information in the used car market. Federal Trade Commission.

- Lacko, J. M., & Pappalardo, J. K. (2004). The effect of mortgage broker compensation disclosures on consumers and competition: A controlled experiment. Federal Trade Commission.

- Lacko, J. M., & Pappalardo, J. K. (2007). Improving consumer mortgage disclosures: An empirical assessment of current and prototype disclosure forms. Federal Trade Commission.

- Lacko, J. M., & Pappalardo, J. K. (2010). The failure and promise of mandated consumer mortgage disclosures: Evidence from qualitative interviews and a controlled experiment with mortgage borrowers. American Economic Review: Papers and Proceedings, 100, 516–521. ArticleGoogle Scholar

- Levine, D. K. (Ed.). (2012). Is behavioral economics doomed? The ordinary versus the extraordinary. Open Book Publishers.

- Lunn, P. D. (2012). Behavioural economics and policymaking: Learning from the early adopters. The Economic and Socail Review, 43, 423–449. Google Scholar

- McAlvannah, P., Anderson, K., Letzler, R., & Mountjoy, J. (2015). Fraudulent advertising susceptibility: An experimental approach (Federal Trade Commission Working Paper NO.325).

- McFadden, D., & Train, K. (2019). Welfare economics in product markets (Working paper). https://eml.berkeley.edu/~train/papers.html (accessed 19 May 2019).

- Muris, T. J. (2002). The interface of competition and consumer protection. Prepared remarks presented at the Fordham Corporate Law Institute’s twenty-ninth annual conference on international antitrust law and policy. New York. Retrieved from https://www.ftc.gov/sites/default/files/documents/public_statements/interface-competition-and-consumerprotection/021031fordham (accessed 23 December 2021).

- Nelson, P. (1970). Information and consumer behavior. Journal of Political Economy, 78, 311–329. ArticleGoogle Scholar

- Nelson, P. (1974). Advertising as information. Journal of Political Economy, 82, 729–754. ArticleGoogle Scholar

- O’Brien, D. P., & Smith, D. (2014). Privacy in online markets: A welfare analysis of demand rotations (Federal Trade Commission Working Paper NO.323).

- OFT. (2000). Consumer detriment. London: Office of Fair Trading, contains public sector information licensed under the Open Government Licence v 3.0.

- Owen, D. K., & Plyler, J. E. (1991). The role of empirical evidence in the federal regulation of advertising. Journal of Public Policy & Marketing, 10, 1–14. ArticleGoogle Scholar

- Pappalardo, J. K. (1997a). The role of consumer research in evaluating deception: An economist’s perspective. Antitrust Law Journal, 65, 793–812. Google Scholar

- Pappalardo, J. K. (1997b). Regulate, inform, or educate? Choosing efficient consumer policy strategies. Advancing the Consumer Interest, 9(2), 27–31. Google Scholar

- Pappalardo, J. K. (2012). Product literacy and the economics of consumer protection policy. Journal of Consumer Affairs, 46, 319–332. ArticleGoogle Scholar

- Pappalardo, J. K. (2014). Contributions by Federal Trade Commission economists to consumer protection: Research, policy, and law enforcement. Journal of Public Policy & Marketing, 33, 244–255. ArticleGoogle Scholar

- Pappalardo, J. K., & Ringold, D. J. (2000). Regulating commercial speech in a dynamic environment: Forty years of margarine and oil advertising before the NLEA. Journal of Public Policy & Marketing, 19, 74–92. ArticleGoogle Scholar

- Pautler, P. A. (2015). A brief history of the FTC’s Bureau of Economics: Reports, mergers, and information regulation. Review of Industrial Organization, 46, 59–94. ArticleGoogle Scholar

- Raval, D. (2018). Which communities complain to policymakers? Evidence from Consumer Sentinel (Federal Trade Commission Working Paper No.336).

- Rhodes, A., & Wilson, C. M. (2018). False advertising. RAND Journal of Economics, 49, 348–369. ArticleGoogle Scholar

- Russo, J. E., Metcalf, B. L., & Stephens, D. (1981). Identifying misleading advertising. Journal of Consumer Research, 8, 119–131. ArticleGoogle Scholar

- Sandler, R. (2016). You can’t take it with you: Appliance choices and the energy efficiency gap (Federal Trade Commission Working Paper No.330).

- Schmeiser, S. (2014). Consumer inference and the regulation of consumer information. International Journal of Industrial Organization, 37, 192–200. ArticleGoogle Scholar

- Shapiro, C. (1980). Advertising and welfare: Comment. The Bell Journal of Economics, 11, 749–752. ArticleGoogle Scholar

- Sobel, J. (2018). Building an economic theory of deception, persuasion, and information sharing. National Science Foundation Award Abstract #1757250. https://www.nsf.gov/awardsearch/showAward?AWD_ID=1757250&HistoricalAwards=false (accessed 23 December 2021). (This grant led to publication of Sobel, J. (2020). Lying and deception in games. Journal of Political Economy, 128(3), 907-947).

- Spence, M. (1977). Consumer misperceptions, product failure, and producer liability. Review of Economic Studies, 44, 561–572. ArticleGoogle Scholar

- Stigler, G. J. (1961). The economics of information. Journal of Political Economy, 69, 213–225. ArticleGoogle Scholar

- Sullivan, M. W. (2017). Economic issues: Economic analysis of hotel resort fees. Federal Trade Commission.

- Sunstein, C. R., Reisch, L. A., & Rauber, J. (2018). A worldwide consensus on nudging? Not quite, but almost. Regulation & Governance, 12, 3–22. ArticleGoogle Scholar

- Thaler, R. H., & Sunstein, C. R. (Eds.). (2008). Nudge: Improving decisions about health, wealth, and happiness. Yale University Press.

- Train, K. (2015). Welfare calculations in discrete choice models when anticipated and experienced attributes differ: A guide with examples. Journal of Choice Modelling, 16, 15–22. ArticleGoogle Scholar

- Tuchman, A., Nair, H. S., & Gardete, P. M. (2016). Complementarities in consumption and the consumer demand for advertising (Stanford University Working Paper No. 3288).

- Vickers, J. (2003). Economics for consumer policy. British Academy Keynes Lecture. https://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.510.8875&rep=rep1&type=pdf (accessed 23 December 2021).

- White, L. J. (2019). Antitrust economics and consumer protection economics in policy and litigation: Why the disparity? (Working Paper, Stern School of Business, New York University, revised 6 June 2019). https://webdocs.stern.nyu.edu/old_web/economics/docs/workingpapers/2018/antitrust_&_consumer_protection_economics.revised.pdf (accessed 23 December 2021). (Subsequently published as White, L.J (2020). Antitrust economics and consumer protection economics in policy and litigation: Why the disparity? Economic Inquiry, 58(4), 1555-1564).

- Wood, D. H., & Stone, D. F. (2018). You can fool some of the people all of the time: Heterogeneity in consumer deception. Social Science Research Network Abstract #3206620. (June 29, 2018). https://ssrn.com/abstract=3206620 or https://doi.org/10.2139/ssrn.3206620 (assessed 23 December 2021).

Author information

Authors and Affiliations

- Bureau of Economics at the Federal Trade Commission, Washington, DC, USA J. K. Pappalardo

- J. K. Pappalardo