Exporters are encouraged to apply as early as possible in order to avoid unnecessary delays to shipment schedules. Please refer to section F.1, below for processing times.

The first and most important step is to have a complete understanding of the export. What is the item? Where is it going? Who is/are the consignees who will receive the shipment directly, and what are the exporter’s contractual obligations for shipping controlled goods or technology? For what will the exported goods or technology be used, and by whom? The applicant must be able to answer all of these questions in detail before filling in the application.

Foreign Affairs, Trade and Development Canada is committed to respect the personal information of private persons, including safeguarding the confidentiality of information provided by companies and individuals.

Regardless of the method of application, the name and business contact information (such as address, e-mail and telephone number) are required for both the exporter and the consignee(s). The data is collected and used for the following purposes: evaluating and approving applications for export permits for controlled goods and technology; tracking goods and technology exported against authorized permits; and supporting other export processes such as delivery verification.

Depending on the nature and destination of the export commodities, consultations with other government departments may be required as part of the export permit approval process (such as the Department of National Defence, Canadian Nuclear Safety Commission, etc.). The Department of Foreign Affairs, Trade and Development commits that the data are not used for any secondary purpose (e.g. to create profiles or marketing).

All the information collected is retained for a minimum of 2 years after the last administrative use, is stored within the program records of the Export Controls Division, and is noted under the Personal Information Bank: Export Import Controls.

Personal information is protected from disclosure to unauthorized persons and/or agencies pursuant to the provisions of the Privacy Act. While third-party commercial information may be subject to requests under the Access to Information Act, no information contained in an export permit application may be released without first consulting with the applicant.

EXCOL Footnote 15 is an internet-based system which allows applicants to apply for export control documents electronically. EXCOL is offered through the Government of Canada’s Secure Channel and assures client security and privacy for all on-line interactions. Users obtain their own, unique, Government of Canada Key, which allows them to access the system through a web browser.

EXCOL users are either “Recognized” or “Non Recognized”. By default, users are Non Recognized and may apply for Export Permits, International Import Certificates, and Delivery Verification Certificates on-line, as well as attach electronic copies of required supporting documents to their applications.

Applicants who apply or have applied for more than one export permit annually are advised to become Recognized Users of EXCOL. In addition to the functions available to Non-Recognized Users, Recognized Users may also do the following on-line:

The following are current local system requirements to use EXCOL:

In order to support login in EXCOL, cookies will have to be permitted by the user as the system relies on Government of Canada Credential Federation (GCCF) as an authentication mechanism.

Export permit applicants are encouraged to become Recognized Users of EXCOL. This section explains several easy steps to do this.

Recognized User privileges require registration of the exporting company and of each individual representative of the company who will access EXCOL. There are two forms: the Application for an EXCOL Recognized Business and the Application for an EXCOL Recognized Individual. These forms are available for printing from the EXCOL section Footnote 16 of the website www.exportcontrols.gc.ca.

The information provided in the Recognized Business form is used to create an account (EIPA Number) within EXCOL for the corporate entity. Each business then designates individual Recognized Users who will be able to access this information and use EXCOL on behalf of the corporate entity.

A Recognized User form must be submitted for each and every person who needs access to EXCOL on behalf of the Recognized Business, even if there is only one individual from the business who will use EXCOL. Each individual must sign the Recognized User form and thereby attest that (a) he or she understands the rules regarding the Access Code and electronic submissions, and (b) he or she consents to the collection, retention and sharing of the personal information required for the EXCOL account.

Deletions and additions of Recognized Users can be requested in writing at any time.

Steps for EXCOL registration:

For exports of complete firearms or receiver/frames (but not for other firearm parts, accessories, or ammunition):

For all other goods and technology (apart from logs and woodchips), including firearm parts, accessories, or ammunition:

Two separate applications are required if firearms and other firearm parts, accessories, or ammunition are being exported together.

Once you have submitted your application, the system will automatically generate a reference number (Ref. ID). Please quote the Ref. ID on all correspondence regarding your export permit application.

If you have technical difficulties using the EXCOL system, please contact EXCOL Help Desk at 1 (877) 808-8838 or via e-mail to: excol-ceed.TIA@international.gc.ca.

Data entry of all paper applications may delay the processing time for export permit applications. Required forms may be downloaded from the Export Controls Division website at www.exportcontrols.gc.ca (on the EXCOL information page) or may be requested from the Export Controls Division at telephone number (343) 203-4331.

Forms that are not legible may be returned without action.

For exports of complete firearms or their receiver/frames (but not for other firearm parts, accessories, or ammunition):

For all other goods and technology (apart from logs and woodchips), including firearm parts, accessories, or ammunition:

Two applications are required if firearms and other firearm parts, accessories, or ammunition are being exported together.

Export permit applications should be sent, with all supporting documents, by fax to (613) 996-9933 or by mail to: Export Controls Division (TIE), Foreign Affairs, Trade and Development Canada, 125 Sussex Drive, Ottawa, Ontario, K1A 0G2.

The following section describes the content that is required in each field of the export permit application, either in EXCOL or on paper forms.

Applicants should bear in mind that an export permit and all documentation submitted with it are legally binding on all parties once an export permit is issued. The Export and Import Permits Act prohibits the “export or transfer, or attempt to export or transfer, any goods or technology included in an Export Control List or any goods or technology to any country included in an Area Control List except under the authority of, and in accordance with an export permit issued under this Act.” (Section 13) Furthermore, the Export and Import Permits Act states that, “No person shall willfully furnish any false or misleading information or knowingly make any misrepresentation in any application for a permit … or for the purpose of procuring its issue or grant or in connection with any subsequent use of the permit … or the exportation … of goods or technology to which it relates.” (Section 17).

Incomplete export permit applications may not be processed and will be returned without action by the Export Controls Division. Information entered on the export permit application must be consistent with information entered on the Export Declaration (or other export reporting documents) submitted to the Canada Border Services Agency when the items are presented for export. Otherwise the items tendered for export may be detained at the border.

The Client Name is the name of the business or individual acting as Applicant.

Section 7 of the Export and Import Permits Act requires that the Applicant be a resident of Canada (defined as “…in the case of a natural person, a person who ordinarily resides in Canada and, in the case of a corporation, a corporation having its head office in Canada or operating a branch office in Canada”).

The Applicant and Exporter do not need to be identical.

If the Applicant is a business, the Applicant must hold a resident Business Number (formerly known as a GST Number) issued by the Canada Revenue Agency (more information on the internet at www.cra-arc.gc.ca/tx/bsnss/tpcs/bn-ne/menu-eng.html). A Business Number is not necessary for an application by an individual. The Applicant must hold an EIPA Number issued by Foreign Affairs, Trade and Development Canada (application forms are available on the internet at www.exportcontrols.gc.ca) before the export permit application can be processed. However, export permit applications submitted through EXCOL by businesses that do not already have an EIPA Number will be assigned one upon receipt of the export permit application by Foreign Affairs, Trade and Development Canada.

Please note that Canadian telephone numbers should be separated by a dash (e.g., 613-996-2387).

In most instances, the applicant would also be the exporter of the controlled goods or technology. In a case where the applicant and exporter are different entities (e.g. the exporter is a non-resident of Canada), the Client Name provided must be the Exporter, the business or individual which exports the goods or technology or has the legal right to cause them to be exported. The wording “cause them to be exported” does not mean the person involved in the transportation (carriage) of the goods. For more information, please consult the publication “Exporting Goods from Canada, A Handy Guide for Exporters”, available on the internet at www.cbsa.gc.ca.

The Exporter address must be the location from which the goods or technology will be shipped at the time of export. Where the exporter is a non-resident of Canada, the address to be listed in the application will be its foreign address. The exporter name and address provided must match the exporter information as stated in the Export Declaration (B13A) or other documentation which is presented to customs authorities when the goods are presented for export.

The exporter may be a non-resident of Canada but the applicant must always be a resident of Canada. In the case of a non-resident exporter, the applicant accepts legal responsibility for the use of the export permit if issued and is responsible for the export and potential violations.

If the Exporter is a business, the Exporter must hold a resident or non-resident Business Number (formerly known as a GST Number) issued by the Canada Revenue Agency (more information on the internet at www.cra-arc.gc.ca/tx/bsnss/tpcs/bn-ne/menu-eng.html). A Business Number is not necessary for an exporter who is an individual. The Exporter must hold an EIPA Number issued by Foreign Affairs and International Trade Canada (application forms available at www.exportcontrols.gc.ca) before the application can be processed. However, applications submitted through EXCOL by businesses that do not have an EIPA Number will be assigned one upon receipt of the application in the Export Controls Division.

Foreign parties (individuals, companies or other entities) that must be identified in an export permit application typically fall into the following categories:

Information on other foreign parties involved in the export, if any, such as freight forwarders and financial institutions, may be provided by the applicant, or requested in certain circumstances by the Export Controls Division, but does not usually appear on the export permit.

Accurate and complete information about the foreign parties involved in the export of goods and technology from Canada is essential to the Export Control Division’s review of an application. Verification of the legitimacy of the foreign parties to the transaction is one of the factors used to determine whether the proposed transaction is consistent with Canada’s foreign and defence policies.

Such verification is also a responsibility of the applicant. It is expected that Canadian exporters of controlled goods and technology will make appropriate enquiries as to the intended end-use of the export and to fully declare this end-use when making an application. Furthermore, any relevant information pertaining to the proposed export should also be disclosed in the application (see Box 3: Evaluating Foreign Clients below, for more information). In other words, an applicant/exporter should exercise due diligence and know who the foreign parties are, including the end-users.

The term “consignee” refers to the foreign party or parties to whom the Canadian exporter will be shipping the goods or technology to directly.

In many cases, there are only two parties named in an export contract: the Exporter and the Consignee. The Canadian exporter has signed a contract directly with and will deliver the goods or technology to a foreign customer, for their own use. In this case, the customer is the Consignee.

In cases where the Canadian exporter is carrying or shipping goods or technology to several countries (for example, for demonstrations at trade shows or visits to customers), the location in the first country of destination should be used for the Consignee. Other destinations should be described in the Overall Description of Goods and End-Use (see Section E.3.4 below). The Canadian export permit will cover the movement from Canada to the first country of destination and subsequent movements between countries may be subject to foreign export controls.

A “carnet” is a “cargo control document (CCD)” issued by the Canadian Chamber of Commerce. This document may help facilitate subsequent movements between countries. A carnet is an international customs document used for temporary, duty-free exports (i.e., the exported goods will return to Canada after less than 1 year). It is currently accepted in over 71 countries. Items which enter a country under the authority of a carnet are not to be sold. For more information about Canadian carnets, please visit a local Chamber of Commerce or consult the following website:. http://www.chamber.ca/carnet/

Please note that the possession of a “carnet” does not absolve an exporter or importer from the requirement to obtain a permit (if required) in order to export or import goods and technology controlled under the Export and Import Permits Act.

Applicants may submit permit applications with multiple Consignees, provided they are located in the same country.

For a Multiple Destination permit (MDP), choose “Multiple” under “Consignee Type” in EXCOL and then the applicable multiple destination permit type. (For further information on MDPs, see Section F.7, below).

When possible, applicants for export permits are required to identify end-users of the goods or technology proposed for export. In general, the end-user is the entity that employs or uses the goods or technology that were exported from Canada for the purpose for which they were intended.

Box 2: Examples of Consignees and End-Users

The following examples may help to distinguish between consignees and end-users in more complex cases.

Consignee re-sells to end-user: A company in the UK wins a contract to supply parachutes to the UK Ministry of Defence. The UK company buys the parachutes from Canada and, according to its contract with the UK company, the Canadian exporter delivers the parachutes to the UK company. The UK company subsequently sells these Canadian parachutes to the Ministry of Defence. In this scenario, the UK company is the consignee and the Ministry of Defence is the end-user.

Canadian exporter delivers to end-user: A company in the UK wins a contract to source parachutes for the UK Ministry of Defence. The UK company buys these parachutes from Canada and contracts with the Canadian exporter to deliver them directly to the UK Ministry of Defence. In this scenario, the Ministry of Defence is both the consignee and the end-user.

Consignee is a manufacturer: A company in the UK that manufactures pilot ejector seats buys parachutes from Canada. The Canadian exporter delivers the parachutes to the UK company. The UK company sells its pilot ejector seats, which include the Canadian parachutes, to a company in France, which installs the ejector seats on an aircraft. The Canadian exporter has no direct relationship with the French company. The UK company is the consignee and the end-user of the goods exported from Canada (the parachutes). The end-use of the Canadian goods is for the production of pilot ejector seats in the UK, for subsequent use by the French company in the assembly of an aircraft; this needs to be fully described in the Canadian export permit application (preferably in a cover letter or in the “Applicant/Exporter Comments” field, “Items” tab of the permit application).

Parts used for repair overseas: A company in Italy buys spare aircraft parts from a Canadian exporter. According to its contract, the exporter ships the goods directly to a company in Portugal which uses the goods to repair an aircraft owned by the Italian company. In this scenario, the consignee is the Portuguese company and the end-user is the company in Italy.

Multiple trade shows: A Canadian exporter intends to participate in trade shows in 3 different countries within a period of 2 months. The first trade show is in Germany, the next one in France and the last in the Netherlands. After that, the goods return to Canada. The Canadian export permit will identify a consignee in Germany only. The Canadian exporter should obtain a carnet from the Canadian Chamber of Commerce to cover the movement of the goods to France and the Netherlands. The details of the full itinerary must be submitted with the permit application including, if possible, a copy of the carnet.

Box 3: Evaluating Foreign Clients

The following questions are meant to assist exporters to evaluate the legitimacy and credibility of foreign customers who wish to acquire goods or technology controlled under the Export and Import Permits Act. If answers to the following questions raise suspicions about potential foreign customers, exporters should describe the circumstances in their export permit application in the EXCOL field "Overall Description of Goods and End-Use".

In many cases, the Consignee is the end-user of an exported good or technology. In other cases, when there are several foreign parties with an interest in a transaction, the end-user may be more difficult to identify.

A foreign manufacturer that uses goods (such as components, assemblies, etc.) or technology to produce or develop new products, or which integrates them into new products, is the end-user of the goods or technology exported from Canada. Subsequently, the new products may be sold by the foreign manufacturer to a third party. The foreign manufacturer may consider the buyers of these new products with Canadian content to be its own end-users.

In cases where the Consignee resells or distributes the goods or technology (in their original form, as they were exported from Canada), the Consignee is not considered to be the end-user. In this case, the end-user would be the third party who will acquire the goods or technology.

In the case of repairs, the entity which owns the goods that are being repaired is typically the end-user.

If the roles of the parties are uncertain, applicants should provide sufficient information about the transaction for the Export Controls Division to make a determination, including copies of contracts and invoices.

End-use assurances are an essential part of export permit applications. More information about end-use assurances can be found in section E.4.2 below.

For the purpose of export permit applications, consignees are located outside Canada. Export permit applications that list a Canadian consignee address cannot be processed and will be returned without action.

Consignee addresses should identify the location of the consignees to whom the goods or technology are to be shipped or conveyed to directly. Consignee addresses must be complete. Post office boxes alone are not acceptable. Where available, consignee website addresses should be indicated along with contact e-mail addresses.

When entering telephone and fax numbers, applicants should separate country and area codes by using a dash between each set of numbers (e.g., 1-613-996-2387). Applicants should verify all consignee contact information (including telephone and fax numbers, e-mail addresses, and websites). Information that is found to be incomplete or inaccurate may result in the return of the export permit application without action.

Exporters may wish to refer to Canada Border Services Agency Memorandum D20-1-1 Footnote 24 , which provides a definition of consignee for the purpose of export reporting.

This field is used by the applicant/exporter to share data with their permit officer. It is used to provide details/clarification on the goods and their end-use Footnote 25 .

The exporter should provide general information about the proposed export in this field, including the following (as applicable):

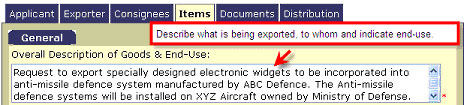

Example of how to complete “Overall Description of Goods & End-Use” field:

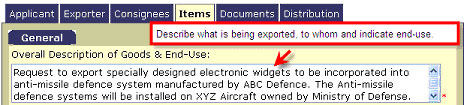

As illustrated below, in this field the applicant may, if available and desired, include additional comments which are relevant and which may help understand the application, such as:

Where the above listed information is provided in the “Applicant/Exporter Comment”, a separate cover letter need not be submitted. In complicated transactions, the Applicant may provide a cover letter clearly detailing the relevant information in order for the Export Controls Division to fully understand and assess the transaction and the proposed export.

Indicate the type of export, whether permanent (the items will be exported and are not intended to return to Canada) or temporary (the items will be exported and are intended to return to Canada after a period of time).

Permits for temporary exports are common for controlled items exported for trade shows, exhibitions, demonstrations, provision of services, repair by the original manufacturer, and other activities after which the items will be returned to Canada. Exporters must apply for an export permit in the normal manner and must note in the body of the application that they are asking for a permit for a temporary export (including the required validity date for the permit). In granting an export permit for a temporary export, the Export Controls Division may place certain conditions on the export. These conditions may include:

Box 4: Applications to Export Goods Temporarily (including for Repairs, Upgrades, and to Loan Equipment)

In cases where equipment is being temporarily returned to the manufacturer or a foreign client for repair, maintenance upgrade or on loan, the value on the permit application should be stated in Canadian dollars as the normal commercial value of the goods or technology being exported.

For clarity, the Item Description of each good that is being temporarily exported should contain the following: “(to be repaired.)”, “(to be upgraded)”, or “(on loan)”.

Examples as they might be displayed on an export permit:

| Item No. | Item Description | Quantity | Unit Value | Total Value |

|---|---|---|---|---|

| 1 | X35 microprocessor P/N 12345 (to be repaired) | 10 | $560 | $5600 |

| 2 | Utopia display unit Model UPZ02 (to be upgraded) | 2 | $2000 | $4000 |

| 3 | XYZ amplifier Model number ABC (on loan) | 1 | $1000 | $1000 |

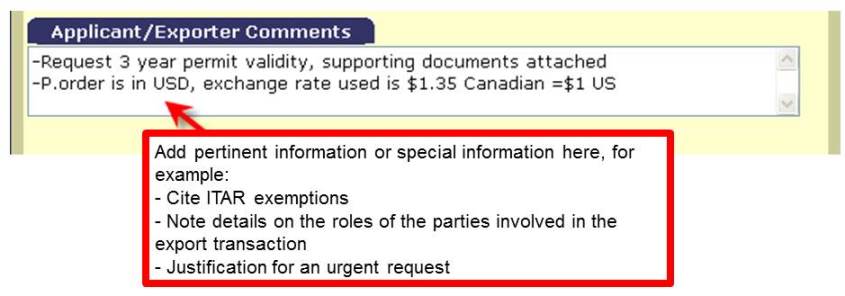

The “Description” field is one of the most important fields of the permit application as it defines the parameters and limitations of the permit. It is also a key element of Canada Border Service Agency review.

The Description is how the goods or technology will be identified on the export permit, which will also be verified against the Export Declaration submitted to the Canada Border Services Agency at the time of export (see section H). Exporters must ensure that item descriptions declared on the customs export declaration is consistent with the description found on the export permit. This may avoid unnecessary delays and potential detention of the goods.

You should limit your item description to the following three points:

1- The name of the item – The name should clearly identify the item like a picture would do; don’t use internal specialized company jargon, use laymen’s terms that licensing and customs officials can relate to;

2- The identification number – Provide a model or part number making sure that it is both on the documents and on the item; don’t put a list of numbers, keep it short;

3- What is it used for or part of - The third line of the item description (see below) may be used to include details helping the reviewers to better understand the nature of the goods being exported (e.g. items to be incorporated in a civilian aircraft XX324).

Item Descriptions that do not follow this format will no longer be considered for further review and the application will be returned without action.

Where quantity is given as a weight or volume, the unit of measure must be stated in the Description field.

Additional description related details on packaging, use, or physical appearance of the product may be provided in the field “Overall Description of Goods and End-Use” (see section E.3.4). Do not include references to the Export Control List (self-assessments should be provided in the field “ECL No.”, section E.3.14), Sales or Purchase Order numbers or information that the sale was made in another foreign currency (e.g. that the sale was in US dollars). This information can be placed in the “Applicant/Exporter Comments” field.

When exporting complete systems or items such as aircraft, aircraft simulator or vehicle, the same approach may be taken. A single line item description may be used to describe the item, for example, “Ford 2001, F-350 Super Duty Truck”. However, if the item will be disassembled for shipment into several major components, these components should be clearly reflected in the line item description. For example, a disassembled car might be described as follows: “disassembled Ford 2001, F-350 Super Duty Truck, components include 5.4 L V8 engine block, Chassis, body”.

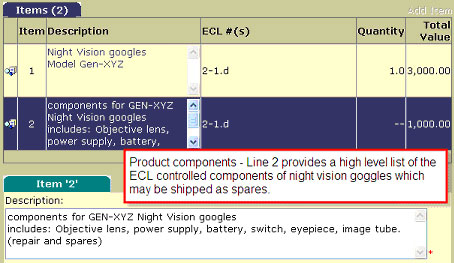

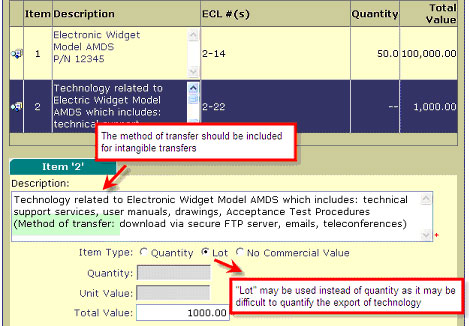

When exporting spare parts for a complex item, exporters should use several lines to reflect the main systems. For example, a helicopter might be broken down by the following systems: Fuselage, Wings, Flight Controls, Avionics, Engines, Hydraulics system. Each line item description should include a high level list of the types of items that would be exported under each of these systems. “Lot” may be used instead of specific quantities when grouping these types of exports.

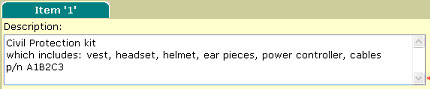

Example of how to complete line item description in EXCOL:

A kit is a collection of goods that are sold together as a defined product (as opposed to a collection of spare parts put together for a specific customer).

When exporting "Kits" that contain a mixture of articles, the description line should include the kit name, a high level list of the items which are included in the kit, and an identifying number if available. For example:

Similarly, when exporting spare parts for a product, the description line should include a list of the types of components that will be exported and the name of the final product for which they are intended (see line 2 in example provided below).

The ECL covers both physical shipments of controlled goods, as well as technology and/or transfers of controlled software or technology by intangible means. As illustrated below, Item descriptions for intangible exports need to describe the goods or technology being exported and provide information about the method of transfer (see also Box 5 – Exports by Intangible Means)

Box 5: Exports by Intangible Means

Certain types of products lend themselves to exportation by intangible means, such as: software and source code, services, and other technology. Exports by intangible means may occur by way of, for example:

How to apply for export permits for exports by intangible means

Transfers by intangible means of items such as software or technology that is subject to export controls must be authorized by an export permit. When applying for export permits which include exports of controlled software or technology by intangible means, the applicant should indicate the product nomenclature that will be exported by intangible means on a separate line on the export permit application. The export permit application line description for items which will be exported or transferred by intangible means should include the following elements:

Line item descriptions should not contain Export Control List numbers or make reference to documents or statements attached or mentioned elsewhere. The line item description entered on the export permit application should stand alone as a description of the export by intangible means, identifying the item being exported or transferred.

Line item descriptions allow the establishment of clear and appropriate parameters which effectively define the proposed export or transfer and support its monitoring. A proper line item description avoids potential confusion for all parties involved in the transfer/export process.

Fictional examples of acceptable item descriptions would be:

Due to the nature of technology and the ability to export intangibles in different forms (e.g., in a physical form or by electronic means), exporters may, when necessary, request quantities as “lots” when applying for an export permit. Total value entered on such applications should reflect the total value of the supply contract over the life of the export permit. In some cases, a condition of using the export permit may be that reports of actual shipments of the products authorized for export must be submitted at regular intervals. In cases where the unit of measure used is “Lot”, exporters may report a share of the total value of the “Lot” exported in the relevant period.

Compliance and records

Exporters of controlled goods and technology are obliged by law to maintain for a period of six years all records with respect to exports made under the authority of export permits issued under the EIPA. This record-keeping obligation applies equally to exports by intangible means.

The export control function has historically been carried out by a company’s shipping department. However, in the modern environment of electronic communications and globalized technology development – an environment in which exports of controlled technology can take place from a desktop – responsible exporters should ensure that all business units conform to enterprise-wide policies and procedures on export controls compliance.

Select one item type: “quantity”, “lot” or “no commercial value” and provide the corresponding information for the selection.

If a unit of measure is used, it should be stated in the item Description. This typically occurs in the case of bulk shipments. For example, to describe an export of 10 litres of milk, the applicant would state "10" in the quantity field and include a description of: "Milk (quantity stated in litres)".

Box 6: Applications to Permanently Export Goods After Temporary Import into Canada (including Exports After Repairs and Returns of Equipment on Loan)

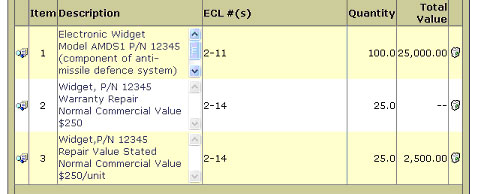

When applying to permanently export goods that have been temporarily imported into Canada and are being returned to a foreign client, the value of each line item should reflect only the cost of new revenue generated due to the transaction, as paid for by the customer for the new export. This amount, in Canadian dollars, is entered in the Unit Value field in EXCOL or on the paper forms.

With respect to repairs, if the cost of repairs is unknown at the time of the export permit application, a high estimate may be entered to ensure that the actual value of repairs which is declared on customs documents at the time of export does not exceed the value stated on the export permit.

The repair value should be zero in the case of repairs made under warranty, which result in no new revenue for the exporter; applicants for such permits may choose the “No commercial value” option in the EXCOL Description field in order to obtain a dollar value of zero.

Similarly, in cases where loaned or leased equipment is being returned to a foreign consignee (that is, the owner of the goods) and does not result in any new revenue for the Canadian business, the Unit Value should be reported as zero.

For clarity, the Item Description of each good that is being returned should contain the following: “(Repair value stated.)” or “(Warranty repair.)” or “(Return of loaned equipment.)”. Furthermore, the Item Description field should include the value that would be charged for the export of each unit of the good if it were new (i.e. the normal sale price or normal commercial value).

Examples as they might be displayed on an export permit:

| Item No. | Item Description | Quantity | Unit Value | Total Value |

|---|---|---|---|---|

| 1 | X35 microprocessor, P/N 12345 (Warranty repair. Normal commercial value is $560 per unit.) | 10 | $0 | $0 |

| 2 | Utopia display unit, Model AZP-02 (Repair value stated. Normal commercial value is $2,000 per unit) | 2 | $400 | $800 |

| 3 | Amplifier, Model NEW-03 (Return of loaned equipment. Normal commercial value is $1,000 per unit.) | 1 | 0 | 0 |

| Item No. | Item Description | Quantity | Unit Value | Total Value |

|---|---|---|---|---|

| 4 | X35 microprocessor P/N XYZ (return of non-conforming good to supplier) | 1 | $560 | $560 |

“No Commercial Value” is used when there is a positive quantity but a dollar value of zero (used, for example, when goods are being exported under warranty; see Box 6 for more information).

“Lot” should be chosen for “bulk goods” or when the goods described on a single line cannot be easily quantified but they have a positive dollar value for the purpose of the application. Lots are commonly used with exports of information that may be transferred in different intangible forms (such as in meetings and electronic downloads).

“Lot” may also be chosen for zero valued transactions, as in the export of information through intangible means (e.g. updates and patches to previously exported software). In this case, a nominal value of $1.00 or less may be indicated in the “Total Value” field, as the system requires that a value be indicated when choosing “Lot”.

If repairs are anticipated over the duration of the permit, Exporters may add additional lines to cover those potential repairs on their initial permit application.

The example below illustrates how to structure a permit to cover anticipated repairs. In this example, the applicant has requested to export 100 widgets. Based on historical sales, the exporter estimates that for every 100 widgets sold, 25% of the units will be shipped back for repair. Line 2 reflects the number of goods to be repaired under warranty. If a warranty plan will not cover all repairs, a third line item can be added to cover anticipated repairs with a fee. By using this approach, exporters do not have to apply for a new permit if their product is returned for repair during the validity period of their permit.

Value must be expressed in Canadian dollars and should represent the invoice or sale price paid by the foreign customer (see Box 7 below on how to account for exchange rate fluctuations if the sale price is denominated in another currency). If the exact unit value is not known at the time that the application is submitted, it should be estimated. Exporters should ensure that the actual value that will be declared at the time of export does not exceed the estimate declared on the export permit.

For permanent exports of new goods or technology, the value should reflect the full sale price.

For permanent exports of goods repaired in Canada, the value should reflect only the cost of repairs in Canada (see Box 6: Applications to Export Goods Repaired in Canada).

The value of temporary exports from Canada should be declared as the normal commercial value of the goods or technology being exported.

Exports which exceed those defined on the export permit in value or quantity may constitute a violation of the Export and Import Permits Act. If the value of goods or technology increases between the time the application was made and the date of export, a Permit Amendment Request should be submitted to change the permit prior to shipment.

Box 7 : Exchange Rate Fluctuations

The value of an export authorized by an export permit may not exceed the value stated on the permit. Since this value is stated in Canadian dollars, when sales are denominated in another currency, exchange rate changes may cause the value of the export to exceed the value stated on the permit, even though the goods or technology being exported are otherwise as described on the permit.

This problem may be more acute in the case of permits that are valid for several years. This problem is particularly important when exporters are required to submit periodic reports of exports made under the authority of a permit (see for example section G.2.1 below).

To avoid this problem, applicants are encouraged to use an estimated rate of exchange (up to 15% above the actual rate) that offsets potential currency fluctuations. The exchange rate used should be identified in the “Exporter/Applicants Comments” field of the permit application (for example, "Sales are made in US dollars. Exchange rate used here is $1.35 Canadian = $1 US").

When the exchange rate fluctuates outside this range, exporters must submit a Permit Amendment Request to change the unit value reflected on the permit prior to shipment in order to ensure that the Canadian dollar value of an export authorized by a permit does not exceed the value stated on the permit. The applicant should attach a statement which notes the exchange rate at the time of the original application and the prevailing exchange rate at the time of the amendment request.

U.S.-origin value is an estimated percentage of the total value in Canadian dollars.

If the goods or technology being exported contain some U.S. content and are controlled in Groups 2 or 6, or by Item 5504 of the Export Control List, refer also to section E.4.3 below.

Country where the goods or technology were produced or assembled into their final form prior to export from Canada.

Specify whether the goods are designed or modified for (select one): "military use", "space use", "nuclear use", "other (specify)". Appropriate supporting documentation should be attached to the application. Otherwise leave blank.

For information security products, indicate if the goods employ cryptography (including encryption or decryption). Otherwise leave blank.

Optional statements that clarify the nature of the export, such as:

Using the latest version of the Export Control List as published in the Guide Footnote 26 , identify the Export Control List Item number which describes the goods or technology proposed for export. See section C for information on determining the Export Control List Item Number.

Specify any additional, supporting documentation that is attached to the application (you must attach some documents, see section E.4 below.)

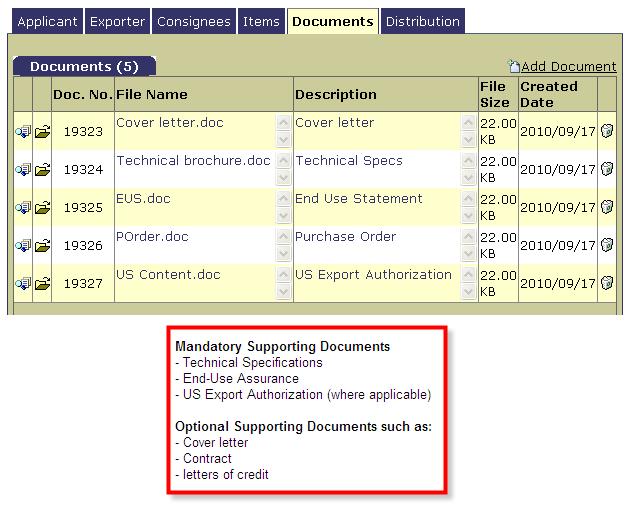

Supporting documentation is an important part of the application. Exporters must submit at least one technical document and an end-use assurance document to supplement the completed export permit application form. Additional documents (such as cover letters, purchase order or contracts) may be added to further support the export request.

Electronic documents (including scans of paper copies) should be attached to export permit applications made on-line using the EXCOL system. As indicated in the example on the next page, Applicants are requested to separate different documents for ease of reference at different stages of the review process.

The Export Controls Division undertakes a technical assessment of the goods, services, and technology listed in the export permit application to determine under which Export Control List Item(s) they fall. For this purpose, technical specifications of the export must be detailed and adequately describe the characteristics of the goods, services and technology. Enough details must be provided to establish the true nature of the items. These could be provided in the form of drawings, data sheets, manuals, component lists, block diagrams, exploded view drawings, and so on. Marketing brochures may also provide useful additional information. The information that is submitted should make clear the type and function of the goods or technology and provide key technical parameters.

Failure to provide technical specifications for the items may delay the processing of your export permit application or result in it being returned to you without action.

Example of how to list supporting documents in EXCOL:

There are several types of end-use assurance documents. The provision of end-use assurances does not in any way imply that an export permit will be issued. All export permit applications are considered on a case-by-case basis and on their own merits.

Exporters must submit at least one end-use assurance document with their export permit application and are encouraged to include several such documents, as available. This will ensure that the Export Controls Division has a clear understanding of the proposed export and will help to expedite the review process.

An End-Use Certificate is issued by the government of the final destination country and is attached to the Canadian export permit application. An End-Use Certificate:

If an official document from the final destination government is not available, an End-Use Statement from the consignee is generally acceptable (see Box 2 in section E.3.3 above for more information on consignees and end-users).

In certain cases, the applicant may be requested to provide a statement or statements from parties other than the consignee (e.g., in certain cases when the consignee is not the end-user).

An End-Use Statement must be dated (preferably within 6 months from the time the export permit application is submitted) and written on company letterhead in either English or French and should:

An International Import Certificate is provided to the exporter by the final consignee and is issued to the final consignee by the government of the final destination country. It states the items (including quantities and values) which will be imported and provides both governments with an assurance that the goods will not be diverted to illegitimate end-users. The Canadian exporter must attach the International Import Certificate to the export permit application and submit it to the Export Controls Division within the validity period (usually 6 months) of the International Import Certificate.

Import Licences are issued by the government of the final destination country when imports of the items proposed for export from Canada are controlled. If an Import Licence is required, the final consignee must obtain it and provide a copy to the Canadian exporter, who must then attach the copy of the Import Licence to the export permit application.

Applicants are encouraged to attach the documents described below to their export permit applications, in addition to formal end-use assurances. These will ensure that the Export Controls Division has a clear understanding of the proposed export and will help to expedite the review process. However, provision of such information is optional unless specified by the Export Controls Division.

At the discretion of the Export Controls Division, applicants may substitute one or more of the alternative, informal, end-use assurance documents listed below for the formal end-use assurances described above. These informal end-use documents support the applicant’s statements about the destination, consignees, and end-use of the goods or technology proposed for export:

Applicants will need to provide their rationale and/or justification in a cover letter (or under the exporter’s comments in EXCOL), in order to have these informal end-use assurance documents taken into consideration by the Export Controls Division.

Export permits for firearms, firearm components and ammunition may not be issued unless the exporter provides an import licence or other proof that the items will legally enter the country of destination. To meet the requirements of the Organization of American States’ Convention on Firearms, Explosives and Related Material, proof of a transit authorization may be required if the items are transiting a third country.

A Delivery Verification Certificate is typically issued to the consignee by the government of the country to which the item has been exported and provides official confirmation that the goods have been delivered in accordance with the terms of both the Canadian export permit and/or the foreign-issued International Import Certificate. In some cases, Canadian exporters are required to obtain and submit to the Export Controls Division applicable Delivery Verification Certificates as a condition of their export permit.

For information about applying for a Canadian Delivery Verification Certificate (to confirm that items controlled in another country have been imported into Canada), please see section K.3.

The Export Permits Regulations require that a U.S. Export Authorization be provided with every application to export goods or technology that are:

A U.S. Export Authorization means a copy of any of the following approvals issued by the United States (Department of State) under the International Traffic in Arms Regulations (ITAR):

In general, goods that are, or that incorporate, goods or technology that were exported from the U.S. under the authority of the U.S. Department of State and the ITAR fall into this category (see Box 1 for related information).

Exports of goods subject to domestic control under the Schedule of the Defence Production Act that are not of 100% U.S. origin but contain some U.S. content that is not subject to the ITAR must describe what the U.S. content consists of and explicitly state in the application to export those goods from Canada that this U.S. content is not subject to ITAR. In such cases, U.S. Export Authorization is not required.

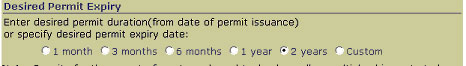

The validity period of an export permit varies depending on the items to be exported and the nature of the transaction. For electronic applications submitted in EXCOL (as illustrated below), Applicants may select a permit expiry date which suits their export requirements and which conforms with the guidelines set out in subsections E.5.1 to E.5.7. Requests for permits which exceed a validity period of 2 years are assessed on a case-by-case basis and are granted at the discretion of the Export Controls Division based on the additional information that should be submitted, as described in E.5.1- E.5.7.

For paper applications, Applicants should state in the “Overall Description of Goods and End-Use” field of the application (see section E.3.4) or in a cover letter if it is known when the export is expected to be completed or if the export permit will be required for a specific duration.

It is strongly suggested that applicants request a validity period which is consistent to the actual needs of the proposed export transaction.

Unless otherwise stated, an export permit may authorize multiple shipments, up to the expiry of the permit and as long as the cumulative total of the quantity or value of items exported does not exceed the quantity or value stated on the permit.

The validity period of export permits may be amended after issuance (see section G.3).

Permits for temporary exports may be valid for up to 2 years.

Permits for permanent exports have validity periods according to the following guidelines.

Standard – up to 2 years; up to 5 years upon request and with evidence of a long-term contract.

Export Control List Items 2-1 to 2-4 – Single shipment for most items to all destinations

As a general rule, export permits for military items falling under Export Control List Items 2-1 through 2-4 will be issued only for a single shipment to a single consignee. The export permit becomes invalid after the first shipment is made even if the shipment is only a partial one. Exporters must re-apply for a new export permit to cover any shortfall. An exception to the single shipment condition may be granted at the discretion of the Export Controls Division.

Export Control List Items 2-1 to 2-22 – Standard – up to 2 years; up to 5 years upon request and with evidence of a long-term contract.

Applicants should note that permits for permanent exports in this Group may be subject to a quarterly reporting condition (see section G.2.1). Such reports must be made even when there have been no exports in a given quarter.

To reduce the number of unnecessary reports, applicants should state when the exports described in the permit application are expected to be made and request a shorter validity period than 2 years where appropriate.

All Group 3 Export Control List Items – up to 5 years.

The exporter must also be in possession of a valid export licence issued by the Canadian Nuclear Safety Commission prior to export if the item proposed for export is subject to controls under the Nuclear Safety and Control Act.

All Group 4 Export Control List Items – up to 5 years.

The exporter must also be in possession of a valid export licence issued by the Canadian Nuclear Safety Commission prior to export if the item proposed for export is subject to controls under the Nuclear Safety and Control Act.

Export Control List Item 5400 when General Export Permit No. 12 does not apply (see section D.4) – up to 5 years.

Export Control List Item 5504: Standard – up to 2 years; up to 5 years upon request and with evidence of a long-term contract.

Export Control List Items 6-1 and 6-2 – Single shipment.

Export Control List Items 6-3 to 6-20: Standard – up to 2 years; up to 5 years upon request and with evidence of a long-term contract.

All Group 7 Export Control Items – up to 2 years.